Mexico City-based financial firm specializes in debt structuring and advisory services.

Leveraging the extensive experience of our team, we are committed to providing comprehensive financial solutions that support the growth and success of our clients.

~US$ 500MM

AUM

15

Executed m&a, equity and debt raisings, fairness opinions, and financial advisory transactions

2

Successful SPAC closings currently listed on Nasdaq

+100

Clients

Who we are

As a leading financial services firm driven by cutting-edge technology

Our core specialization lies in providing customized financial solutions to meet the diverse needs of our clients. Our team of seasoned investment professionals and technology experts collaborate to design investment solutions, offer comprehensive advisory services, innovate all-encompassing financial products, and uphold exceptional service standards that make a significant impact on our industry and society at large.

What we do

1

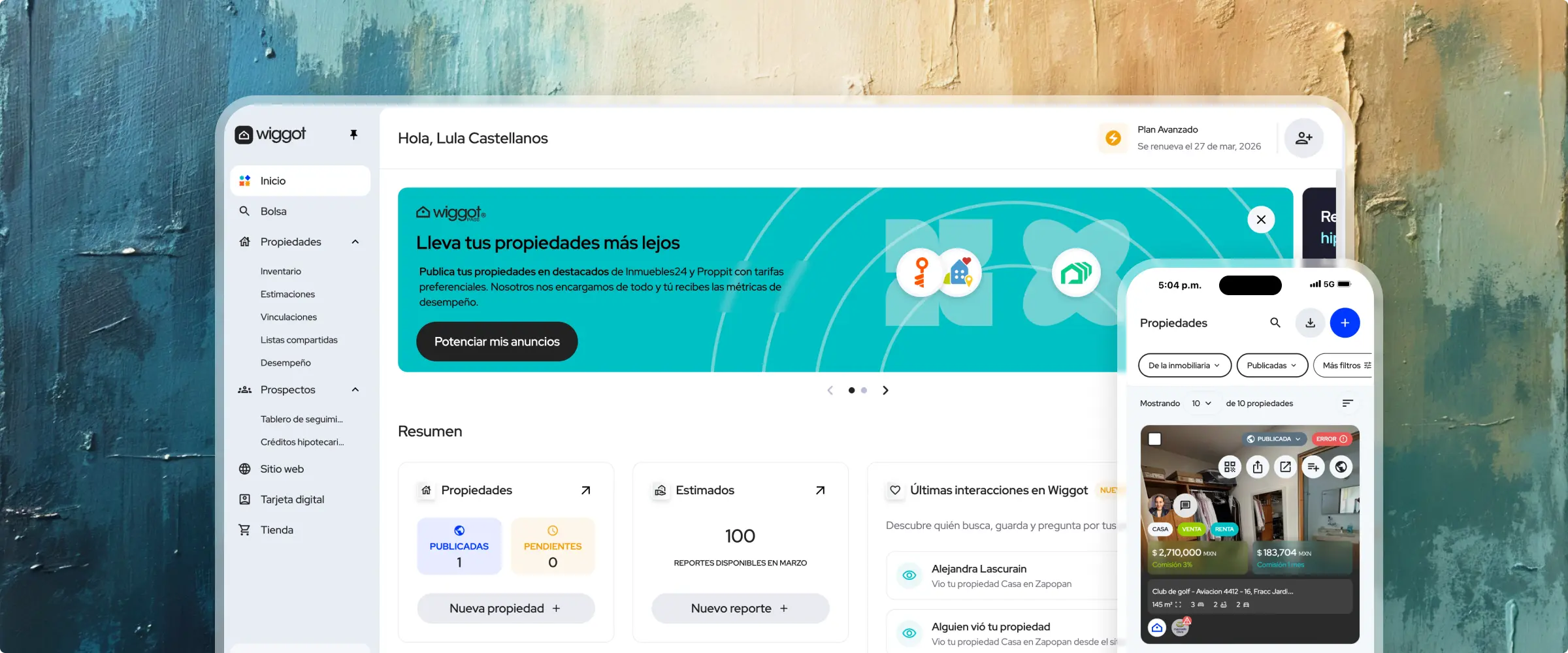

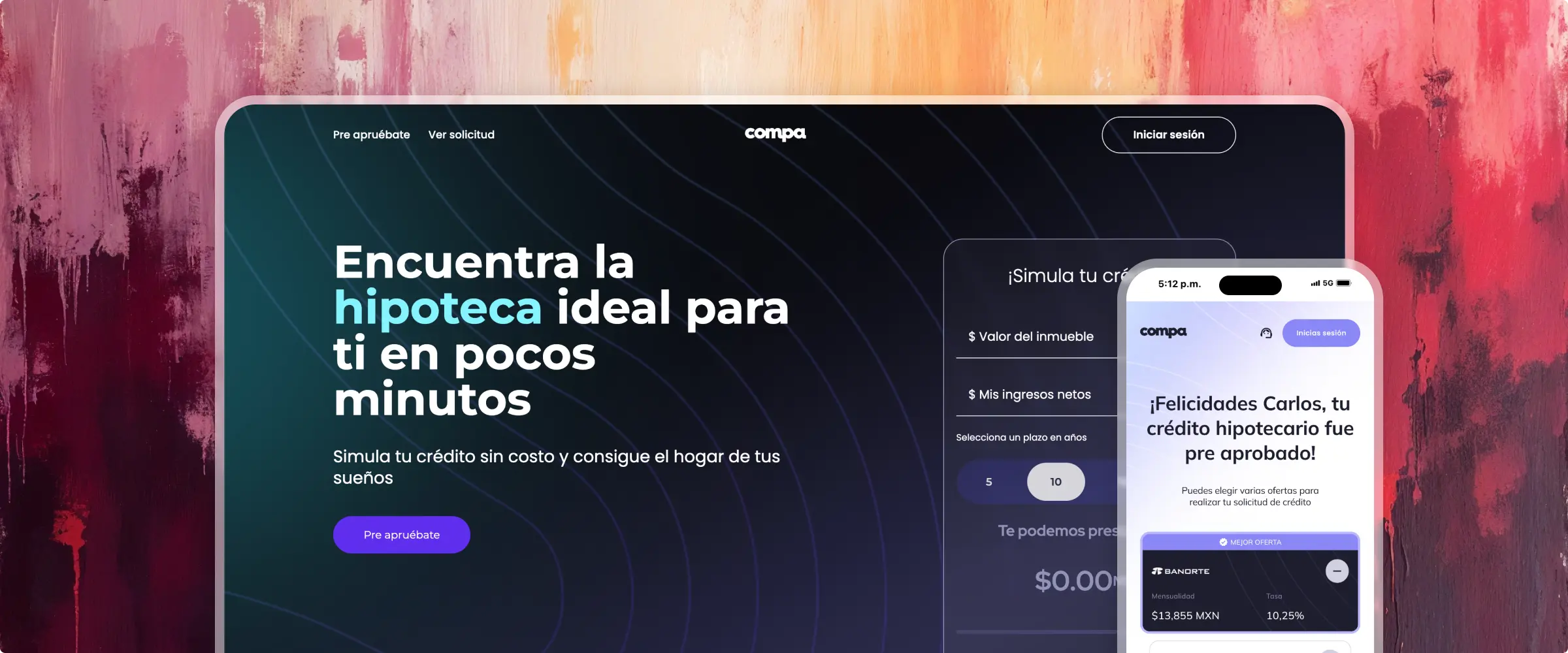

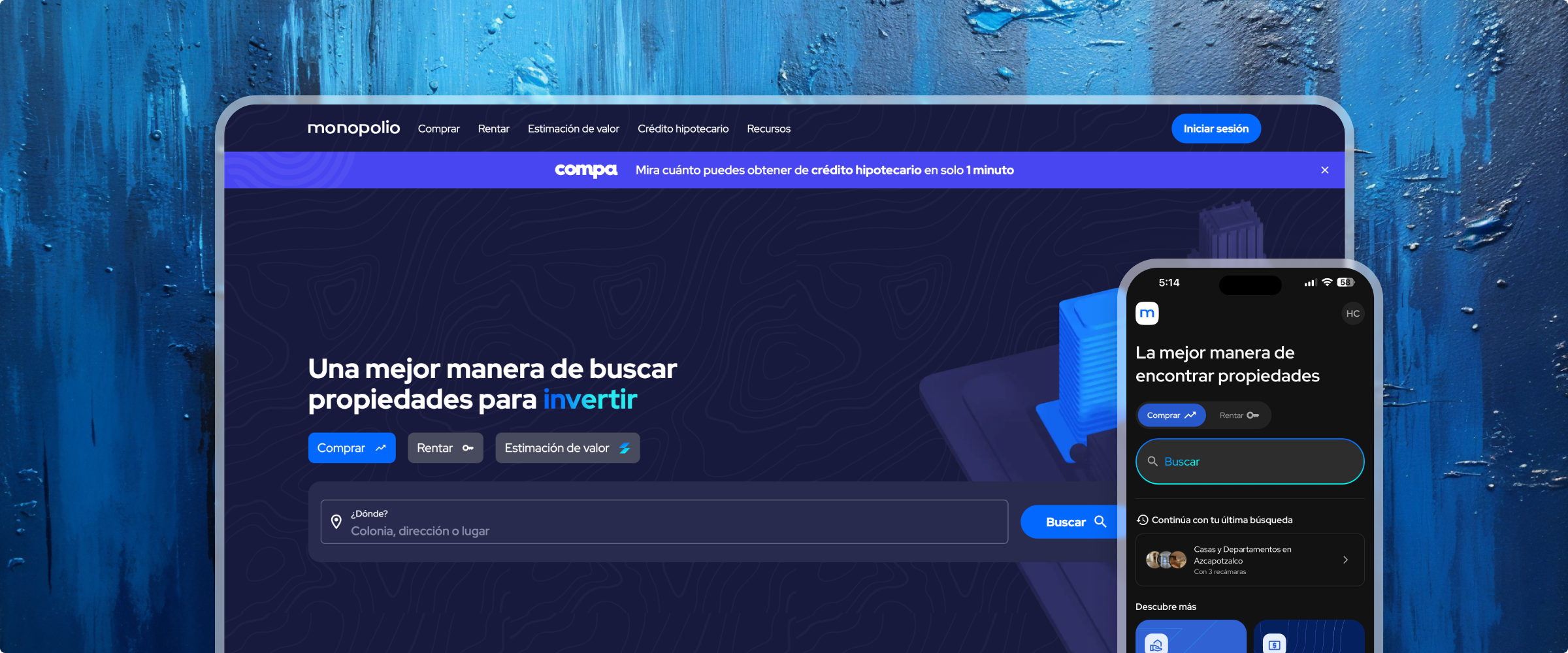

Residential Real-Estate Fintech/Proptech Platform

By cultivating our Proptech/Fintech platform we generate value to home-owners, developers, and real-estate market participants across all stages of their projects. Our proprietary software enables us to offer products that cover the full spectrum of project financing, from pre-development to construction and ultimately to home purchase.

2

SMEs Debt Fund

Our investment vehicle is specifically designed to facilitate debt transactions denominated in both MXN and USD, with a focus on supporting the financing needs of small and medium-sized enterprises (SMEs) in Mexico. As the first Tech-Fund in Mexico dedicated to providing tailored structured financing solutions to local companies, we leverage our expertise to help businesses optimize their capital structures for future growth and development, while capitalizing on their existing strengths.

3

Leisure and Hospitality Fund

Capitalizing on our team's real-estate expertise, we act as financial partners to both global and local hospitality brands nationwide. Our collaborative approach involves thorough analysis of investment prospects, enabling us to identify untapped markets and offer innovative hospitality solutions for the modern digital nomad and travel enthusiast.

4

Advisory, Capital Raisings, and Specialized Vehicles

Our approach to providing financial services and products centers around leveraging the extensive expertise of our team to deliver comprehensive solutions to our clients. Our services encompass a broad range of areas, including mergers and acquisitions, debt and equity financing, financial restructuring, and special-vehicle transactions.

Team

Martin Werner

Founding partner dd3

With more than 16 years of experience from Goldman Sachs, Martin served as Managing Director from 2000 to 2006 and Partner from 2006 to 2016. He successfully led the GS Mexico office to become a premier investment banking institution in the country. Before Goldman Sachs, Martin served as Director of Public Credit and Deputy Finance Minister (1995-1999).

Martin holds a PhD in Economics from Yale University and an Economics Bachelor Degree from Instituto Tecnológico Autónomo de México.

Jorge Combe

Founding partner dd3

Before DD3, he held the position of Managing Director at Goldman Sachs' Investment Banking division in Mexico City from 2010 to 2017. During his time at Goldman Sachs, Jorge led multiple structured deals for companies across Latin America, ultimately becoming the Head of the Real Estate Division in the region. Prior to his time at GS, Jorge worked for GP Investimentos, a prominent private equity firm based in Brazil.

Jorge holds an MBA from the Wharton School of Business and a Bachelor's Degree in Economics from Instituto Tecnológico Autónomo de México.

Our story

DD3 Milestones